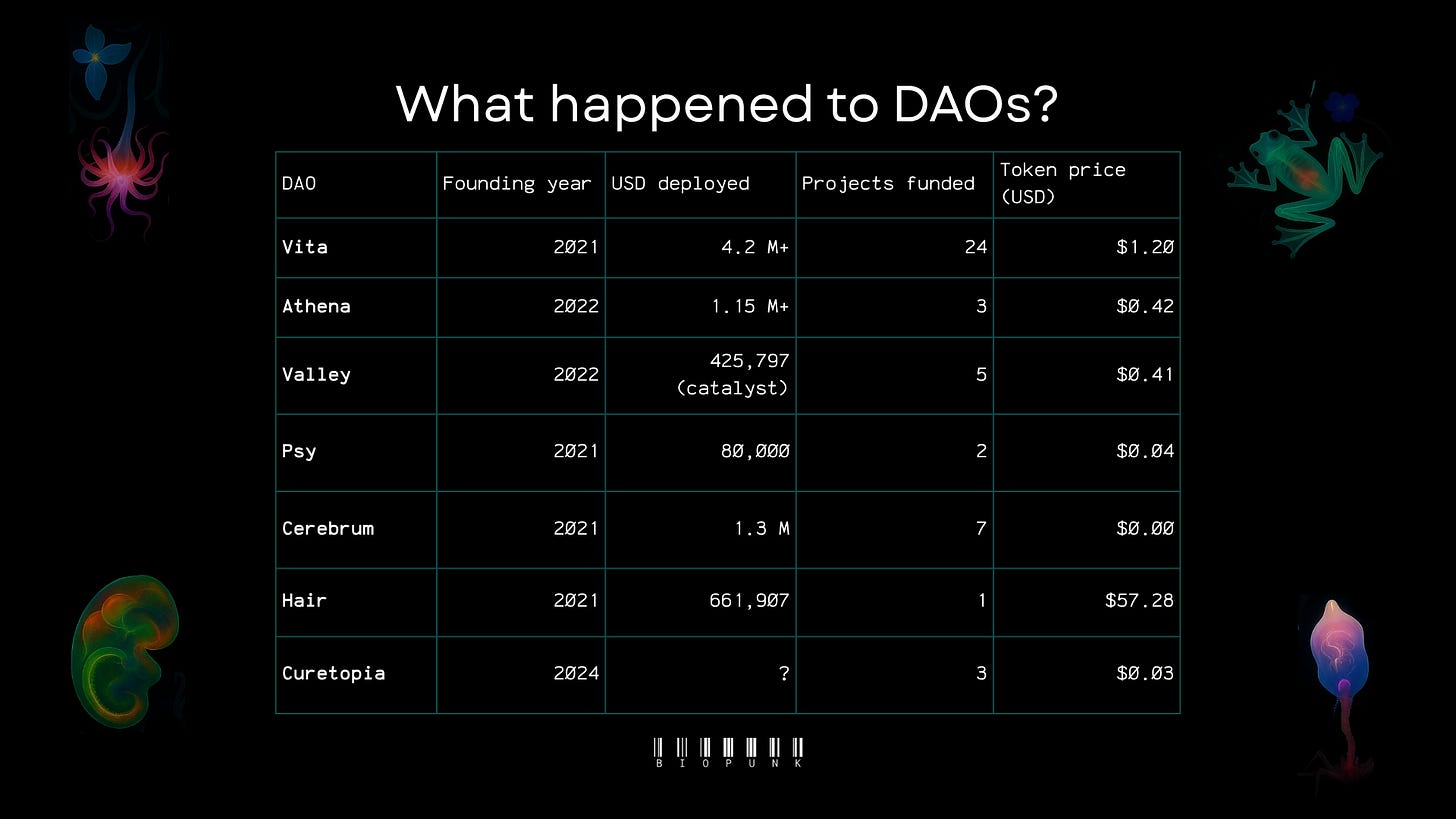

What happened to biotech DAOs?

Four years post-hype, several patents have been minted and filed. Is DeSci really the decentralized movement we envisioned though?

In light of the recent funding cuts to the NIH, the CDC, and the NSF, great pieces have been written on how the social contract established post-WWII built the scientific institutions we know, the limitations it presents to generating more scientific breakthroughs, and where we could be going next.

In this post, I want to focus on the Decentralized Science (DeSci) movement that once promised to change how science is done and enable all kinds of new research that wouldn’t be possible under the old dogma. Four years post-hype, I have a very simple and pragmatic question: what have these rebellious scientists and technologists actually achieved?

Amidst the monkey NFTs, I remember the explosion of biotech Decentralized Autonomous Organizations (DAOs) in 2021. Some wanted to cure aging, others were off for rare diseases, psychedelics, climate, what not. The point was to support ideas and projects so crazy that public institutions wouldn’t even consider them; projects risky enough to scare VCs away; and huge for humanity, if true.

Oversimplifying the concept, DAOs are a group of people organized via blockchain technology, in order to fund a certain category of scientific projects by buying tokens (coins) that give them voting power to decide what specific projects to fund. The system allocates capital directly to the winning scientists, skipping the middleman.

The project’s IP (like a patent or license) can further be turned into a token, an IP-NFT, allowing backers to own a slice of the science itself, and aligning scientific progress with financial upside. DAOs can also buy equity in a company just like venture funds, except token holders can vote to decide which companies to fund and get proportional gains on future returns.

DeSci aims to be the engine in which everyone has skin in the game—funders get a say, researchers get equity, patients help shape the science—DAOs, tokens, and IP-NFTs are the gears designed to keep the engine running, at least in theory…

VitaDAO, perhaps the most popular of all biotech DAOs, is dedicated to funding aging research. Their tRNA suppressor project received $91k from VitaDAO in 2022, raised $300k via their IP-NFT, and this year, they successfully delivered their therapy to six organs in mice without any adverse effects. In preparation for clinical studies in humans next year, they have partnered with Lonza, a CDMO specialized in gene therapy production.

Companies they acquired equity from are also gaining traction. GERO, a techbio company, received $100k from VitaDAO. In 2023, they collaborated with Pfizer to discover potential therapeutic targets for fibrotic diseases in 2023, and this year, they closed a $250M partnership with Chugai Pharmaceutical (owned by Roche) to co-develop novel antibody drugs for aging.

Athena, another DAO that focuses on women’s health research and started in 2022, has partnered with GERO to identify up to 10 novel targets for ovarian aging and potentially develop a drug. They have two other projects on ovarian follicle growth and senescence in ovarian aging.

ValleyDAO, the only major DAO outside the health space, funds climate biotech projects. This year, their chocolate project is partnering with manufacturers to test their microbe-produced cocoa fats. Their hemp textiles project has turned raw hemp fiber into softer, more flexible fibers suitable for sustainable textile applications.

Unlike most of these groups, PsyDAO funds psychedelic science and art. They are asking if we naturally synthesize DMT; they’re developing deoxymethoxetamine (DMXE), a dissociative compound that may offer advantages over ketamine in a medicinal context; and they have established partnerships with indigenous people on the Amazon River who make coffee and art.

CerebrumDAO nurtures potential Alzheimer’s solutions. Their six active projects include a consumer software product; equity on Arctic Therapeutics, a company disrupting amyloid plaques that just closed a €26.5M Series A; and an IP token on Fission Bio, a pre-seed drug discovery platform spun out of Stanford. It was just this year that their $NEURON token was launched.

All the above have tokens are worth $1.2 USD max. At $56 USD per token, HairDAO marks the exception. They’ve gone the extra mile in democratizing science by building anagen, a telehealth platform that matches consumers with doctors who recommend the best out of 18 treatments proven safe and effective in in-vivo clinical trials.

Customers can be rewarded with 10% $HAIR tokens at the time of purchase, 10% after two review time points, and 10% bonus for high quality photos. This not only creates a direct feedback loop, but literally makes consumers part of the whole R&D cycle by giving them voting power for future products. Brilliant, IMO.

Apart from not wearing “DAO” in its name, Curetopia is unique in supporting projects to address the trillion-dollar market TradBio isn’t incentivized to address: rare disease. Most of their projects are either inspired or led by people who had a personal experience with rare disease, who are taking a drug repurposing angle to find cures. A patent is currently being filed for their positive studies in yeast to target AARS2 deficiency. They just listed their token in March.

This is a good point to mention that, before listing tokens for public trading, DAOs can validate their model using grants from other crypto organizations, VC funding, and multisig treasuries (crypto wallets). ValleyDAO, for instance, received early support from Gitcoin, Axial VC, and Protocol Labs while VitaDAO was initially backed by Molecule. Akin to startups, early contributors to the DAO can be partially paid in tokens before these launch.

Molecule who? The technological and legal infrastructure needed for all the IP-NFTs mentioned above, is courtesy of Molecule, a VC-backed DAO that has supported over 35 funded research projects, channeling over $170 M in funding across their ecosystem.

Part of Molecule’s job is to facilitate licensing for researchers. As you may have noticed, a lot of the projects funded by these DAOs are still done by researchers from universities like Stanford and Imperial College London. While it is ironic how some DAOs use these brands to project credibility, these are the kind of quick signals that may convince the skeptics to give DeSci a shot.

On the edge, others are pushing for the decentralization of science, not only in the economic sense but geographically too. Based in Próspera, Roatán, Infinita City is part of a special economic zone where taxes are lower and drug regulatory approval process is streamlined: a safe harbor for renegade scientists, DIY biohackers and serious founders to build cheaper and faster than anywhere else in the world.

Infinita builders are working on gene & cell therapy deployment like Minicircle, cybernetic implants and neurotech trials like Symbiont Labs, diagnostic assistants like Rejuve AI, longevity clinics where patients contribute and shape protocols like Optispan or Everest Health, and more.

Builders can visit Infinita for just $15 USD a day (con 50% OFF para pasaportes latinos, ¡eso!). An all-inclusive, one-week experience (housing + food + access to all places), you’d be paying $875 USD… or I should say $875 LIVES, the unofficial currency of Infinita City is a stablecoin equivalent to $1 USD, that earns you 2.5% cashback. If you ask me, a latina, not the most accessible experience if you add the $1,200 USD flight.

You may also enjoy my piece about Scientist-Influencers and Biohacker-Creators:

For one, I am pleasantly surprised that not all DAOs concern human health. HairDAO, Curetopia, and AthenaDAO support causes that are traditionally underfunded by old systems. Still, the incentive for commercialization is quite clear for most, if not all, projects. “Pure curiosity research” is rare in DAOs.

Furthermore, the initial reliance of DAOs on specific organizations to validate their model, as well as the fact that most financially successful ones are $VITA and $HAIR, makes me wonder whether DeSci could be more of a techbrocracy that creates longevity products for the top 0.1%, than a democracy that attends to the current needs of the bottom billion. I get it though, DAOs != charities.

And decentralization != democratization. Theoretically, DeSci’s open culture leaves doors open to people without credentials. Most biohackers, however, are still first-gen migrants from the old system. “Stanford dropout” still carries the uni tag and unis are still the place where most of us first learn to do science. If even folks in developed nations are reluctant to study bio because of the tough job market, how will biotech be democratized?

In the end, you know that I’m a hyper optimist, and that I too care more about biotech research that can be translated ASAP into products that billions of people use to have a better life. It’s still early, bu I do see in DeSci a better opportunity than in academia to build new biotech products faster and in places that haven’t traditionally been hubs. As the ecosystem grows, I think it can become an open harbor for people from different backgrounds to become biotech builders too.